2025-06-03

In recent decades, Chinese mainland has significantly improved its international status in the field of monochrome liquid crystal display (LCD, LCM), especially showing strong competitiveness in market segmentation and technical expertise. At the same time, the impact of changes in tariff policies on the export of liquid crystal products presents complex and phased characteristics, which are analyzed as follows:

1. Chinese mainland The international market position of monochrome liquid crystal

1. Technology cultivation and market share

Chinese mainland By focusing on niche markets over the long term, companies have secured a significant position in the monochrome LCD market. For example, Dalian Eastern Display Co. Ltd., which has specialized in monochrome LCD screens for 35 years, has developed products with ultra-wide temperature and ultra-low power consumption. The company offers over ten thousand product types, making it a leading player in the global monochrome LCD screen market. According to market reports, Chinese companies are among the top core manufacturers in the global monochrome LCD display market in 2023, particularly excelling in technologies such as VA/TN/HTN/STN/FSTN.

2. Industrial chain support and localization

China’s new display industry chain is becoming more and more perfect, and the localization rate of upstream raw materials (such as glass substrate and polarizer) is gradually increasing, which reduces supply chain risks and enhances industrial resilience. This provides a foundation for the large-scale production and cost control of monochrome liquid crystal products.

3. Application scenario expansion

Monochrome LCDs are widely used in industries that require high stability and reliability, such as industrial control, medical devices, and in-vehicle displays. Chinese companies are gradually replacing Japanese and Korean products in these markets through their high cost-performance ratio and technical adaptability. For example, Dalian Eastern Display Co. Ltd.’s LCD screens are widely used in automotive instruments, industrial instruments, medical devices, and white goods.

Second, the impact of tariffs on the export of liquid crystal products

1. Short-term benefits of tariff adjustment between China and the US

In May 2025, China and the United States reached a phased tariff adjustment agreement, suspending the additional 24% tariffs and retaining the 10% base tariff. This policy reduced export costs and spurred a surge in short-term orders. For instance, American buyers on cross-border e-commerce platforms accelerated their stockpiling within a 90-day window, significantly benefiting industries with reduced tariffs, such as machinery and consumer goods. Additionally, LCD products, as electronic components, also saw an increase in exports.

2. Long-term challenges and coping strategies

Uncertainty of tariffs: The US may still restrict China’s display industry through technical restrictions (such as section 337 investigations) or by resuming additional tariffs. For example, Corning has accused Chinese glass substrates of patent infringement in an attempt to curb the upgrading of China’s industrial chain.

Global capacity layout: In order to avoid tariff risks, top enterprises accelerate the construction of overseas capacity. TCL, Hisense and other enterprises realize tariff reduction through factories in Mexico and Vietnam, and transfer part of LCD module production to Southeast Asia to maintain the competitiveness of exports to the United States.

3. Regional trade agreements help

The signing of the Regional Comprehensive Economic Partnership (RCEP) has reduced tariffs in the Asian region and promoted the export of Chinese LCD products to ASEAN, Japan and South Korea. The tariff reduction has further consolidated China’s position in the regional supply chain.

Third, future trends and suggestions

1. Technology upgrading and high value-added products

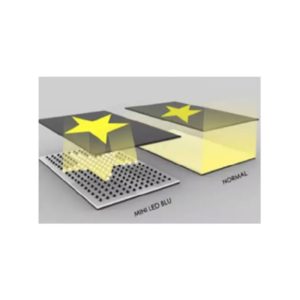

Chinese enterprises need to continue to invest in the research and development of new display technologies such as Mini LED and Micro LED to cope with the competition of OLED in the middle and high-end market. For example, TCL Huaxing has opened up a differentiated route through printed OLED technology, while BOE has laid out high-generation OLED production lines to enhance the competitiveness of large-size panels.

2. Strengthening supply chain resilience

Strengthen the independent control of key materials (such as mask plates and glass substrates) and reduce external dependence. For example, the expansion of Qingyi Optoelectronics, Shanjin Optoelectronics and other enterprises in the field of mask plates and polarizing plates has improved the security of the industrial chain.

3. Market diversification

While consolidating the European and American markets, we will expand emerging markets such as Latin America and Africa, and use the policy dividends of RCEP and “Belt and Road” to spread risks.

In summary, the Chinese mainland monochrome liquid crystal industry has risen to the global top tier thanks to its technical focus and industrial chain integration. While tariff policies have provided short-term export benefits, they also necessitate long-term strategies to address technological barriers and geopolitical risks. By upgrading technology, globalizing production capacity, and fostering regional cooperation, Chinese companies are poised to continuously expand their international market share in a complex trade environment.