2025-05-09

I. Technology development trend

1. Low power consumption and energy saving design

-Reflective technology popularization: by eliminating the backlight and relying on ambient light reflection, the power consumption is reduced to 1/10 of that of traditional LCD, which is widely used in the fields of Internet of Things sensors, electronic tags and so on.

-Dynamic refresh rate optimization: Some manufacturers (such as Sharp and E Ink) have introduced “partial refresh” technology, which consumes power only when data is updated and has zero power consumption for static images, thus extending battery life.

-Solar energy driven compatibility : The new monochrome LCD supports solar power supply and is suitable for outdoor equipment (such as agricultural monitoring terminals).

2. Enhanced adaptability to extreme environments

-Wide temperature range performance: Industrial-grade products (such as Qun Chuang Optoelectronics) can operate stably from-40°C to 105°C, meeting the requirements of vehicle and aerospace.

-Shock resistance and dustproof: using full bonding process and reinforced glass, improve the durability of industrial machinery and mining equipment.

3. Show performance improvement

-High contrast (> 20:1): Improved liquid crystal alignment and drive circuit to improve readability in bright light.

-Flexible substrate applications: Use plastic substrates instead of glass to achieve flexible designs (such as medical wearables).

4. Manufacturing process innovation

-Lead-free and environmentally friendly materials: in line with the EU RoHS 3.0 standard, reducing production pollution.

-Micro-LCD miniaturization technology: Develop high resolution screens (such as 400 x 300 pixels) less than 1 inch for miniature instruments.

Second, the application field is expanded

1. Industrial automation and IIoT

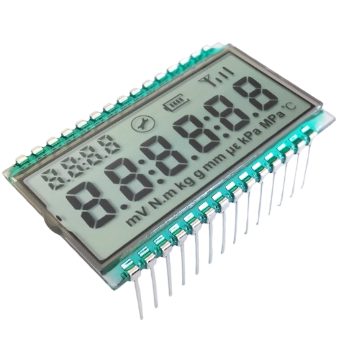

-HMI human-machine interface: replace LED digital tube in PLC control panel and machine tool operation terminal, and support multi-level menu interaction.

-Predictive maintenance system: integrated into sensor nodes to display real-time device status data.

2. Medical equipment

-Portable diagnostic instruments: blood oxygen meter and electrocardiogram machine use low-power single-color LCD to meet the requirements of FDA Class II certification.

-Wearable monitoring devices: such as blood glucose monitors, which can be used to achieve 24-hour continuous display with long battery life.

3. Smart infrastructure

-Smart meters and water meters: more than 200 million units deployed worldwide (Berg Insight data), monochrome LCD is favored due to its life span of more than 10 years.

-Electronic Shelf Tags (ESL): The market size reached $1.5 billion in 2023 (Yole forecast), with reflective LCDs accounting for 30% of the market share.

4. Emerging consumer electronics

-Minimalist design watch: For example, some sports watches in the Garmin section use Memory LCD, which is clear in sunlight and can be used for 30 days.

-Low-end mobile phone backup screen: Feature phones in Africa and Southeast Asia still rely on a monochrome secondary screen to display basic information.

Third, market competition pattern

1. Major vendor dynamics

-Japanese manufacturers: Sharp (Sharp) launched a series of ultra-thin 0.5mm series, focusing on vehicle-grade certification.

-Taiwan: AUO (Aurora) focuses on high contrast industrial screens, increasing its market share to 18% in 2023.

-Mainland China: Tianma Microelectronics expands flexible monochrome LCD production capacity, with a cost 20% lower than that of Japanese companies.

2. Competition for alternative technologies

-E Ink (E Ink): It squeezes LCD share in ESL, but still lags behind LCD in response speed and grayscale.

-OLED: The cost of color OLED has decreased, but the life of monochrome OLED is short (about 10,000 hours), which makes it difficult to replace industrial LCD.

Iv. Future trend forecast

1. Market growth

-CAGR of 3.5% (Grand View Research) from 2023 to 2028, with size increasing from $1.2 billion to $1.45 billion.

-Growth drivers: Industry 4.0, global smart grid construction, ESL popularization.

2. Technology convergence

-AIoT integration: the screen is embedded with sensors to directly display AI analysis results (such as equipment fault warning).

-Transparent display: Develop monochrome LCD with transmittance>80% for AR glasses auxiliary information layer.

3. Regional market differentiation

-The Asia-Pacific region led the growth (more than 45%), driven by manufacturing upgrades in China and India.

-Europe’s stringent energy efficiency standards accelerate the replacement of reflective technologies.

V. Challenges and countermeasures

-Challenge: Breakthroughs in color e-paper technology could threaten niche markets.

-Countermeasures: Deepen the industrial and medical segments, and strengthen the irreplaceability in extreme environments.

tag

Monochrome LCD continues to thrive in specific scenarios due to its reliability and low cost. In the future, technology will be further deepened in the direction of ultra-low power consumption, environmental adaptability and intelligence, consolidating its core position in the B-end market such as industry and medical treatment.

Dalian Eastern Display Co., Ltd. has been deeply involved in the LCD and related display fields for over three decades, making it a well-known company in the industry. It provides professional display solutions to customers in automotive, medical, industrial instruments, and home appliances sectors. The company is a strategic partner of renowned domestic and international brands such as Haier, Hisense, Midea, FAW, Dongfeng, Zoomlion, Sany Heavy Industry, Panasonic, and Omron. Over the years, Dongxian has consistently adhered to independent innovation, offering leading and distinctive display solutions to help customers enhance product performance, quality, and market competitiveness.