Choosing the right exit strategy for your custom OLED display project is crucial for maximizing return on investment (ROI) and ensuring a smooth transition. This guide explores various options, considering factors like project stage, market conditions, and your long-term goals. We'll delve into the specifics of each exit strategy, helping you make an informed decision.

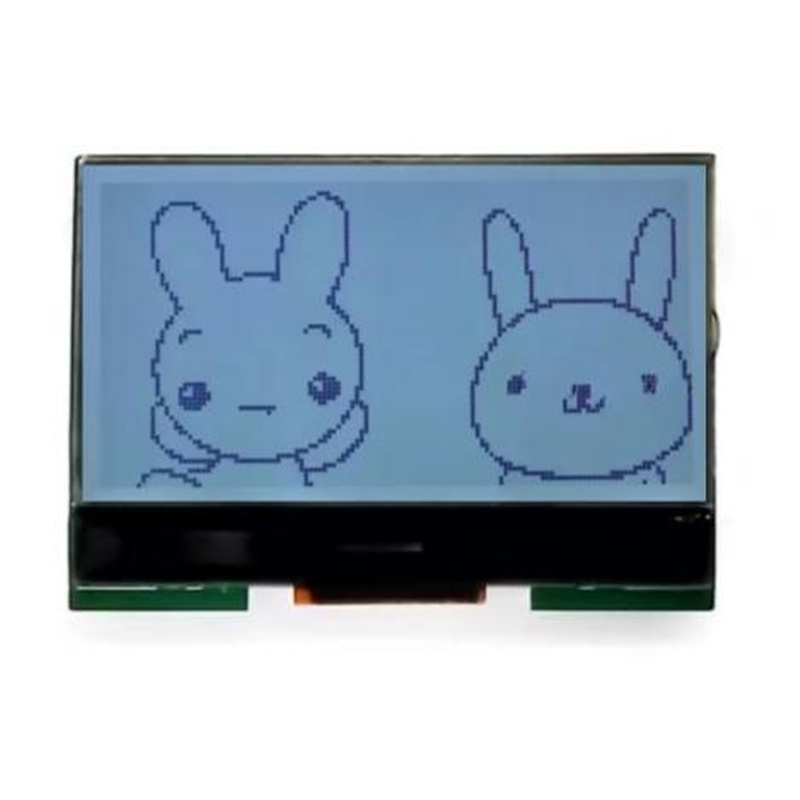

Before considering exit strategies for your best custom OLED display project, thoroughly evaluate its current status. This involves assessing market demand for the specific features and functionalities of your display. Is there a niche market you can dominate? Are there larger players who might be interested in acquiring your technology or your existing production line? Conduct thorough market research to identify potential buyers or partners. You may find valuable insights by analyzing competitor offerings from companies like Dalian Eastern Display Co., Ltd. (https://www.ed-lcd.com/), a leading provider in the display industry. Understanding their strengths and weaknesses can inform your own strategic decisions.

This is a common exit strategy, particularly for successful projects with a strong market position. A larger company might acquire your project to expand its product portfolio, gain access to your technology, or eliminate a competitor. This often involves negotiating a favorable sale price, which can be significantly influenced by your project's profitability and market potential. Preparing a comprehensive business plan showcasing your best custom OLED display's unique selling points is crucial for attracting potential buyers.

This option involves collaborating with another company to jointly develop, manufacture, or market your best custom OLED display. This approach can provide access to resources, expertise, and wider distribution networks, reducing risk and potentially leading to greater market penetration. It's a good option if you want to maintain some control over your project while leveraging the resources of a larger partner.

An IPO allows you to raise capital by selling shares of your company to the public. This is a more complex option requiring significant preparation, including meeting stringent regulatory requirements. An IPO is generally suitable for established companies with a proven track record and strong financial performance. If your best custom OLED display is a flagship product within a larger, profitable company, an IPO could be a viable exit strategy.

Licensing your technology to other companies allows them to manufacture and sell your best custom OLED display under their brand. This is a less capital-intensive exit strategy compared to an acquisition or IPO, but it may also result in lower overall revenue.

The best exit strategy depends on numerous factors, including your financial goals, risk tolerance, time horizon, and the current market climate. Careful consideration of these factors, along with professional advice, is crucial for a successful outcome.

| Exit Strategy | Pros | Cons |

|---|---|---|

| Acquisition | High potential return, immediate liquidity | Loss of control, potential for lower valuation |

| Partnership/JV | Shared resources and risk, expanded market reach | Potential for conflicts, slower growth |

| IPO | Significant capital, enhanced brand visibility | High regulatory burden, loss of control |

| Licensing | Lower risk, recurring revenue streams | Lower potential return, less control over production |

Remember to seek professional advice from experienced business consultants and legal professionals to guide you through the process. A well-defined exit strategy, coupled with a high-quality best custom OLED display, will maximize your chances of success.