The flexible OLED display market is dynamic, with rapid technological advancements and evolving market demands. Understanding the optimal exit strategy for your flexible OLED display technology or product is crucial for maximizing return on investment and minimizing risk. This guide explores different exit pathways, offering a comprehensive overview of the considerations involved. We'll examine factors such as market positioning, technological maturity, intellectual property, and financial projections.

The market for flexible OLED displays is experiencing substantial growth, driven by increasing demand from consumer electronics, automotive, and wearable technology sectors. However, this growth isn't uniform across all segments. Certain niche applications may offer more lucrative exit opportunities than others. A thorough market analysis is crucial to identify the optimal exit strategy.

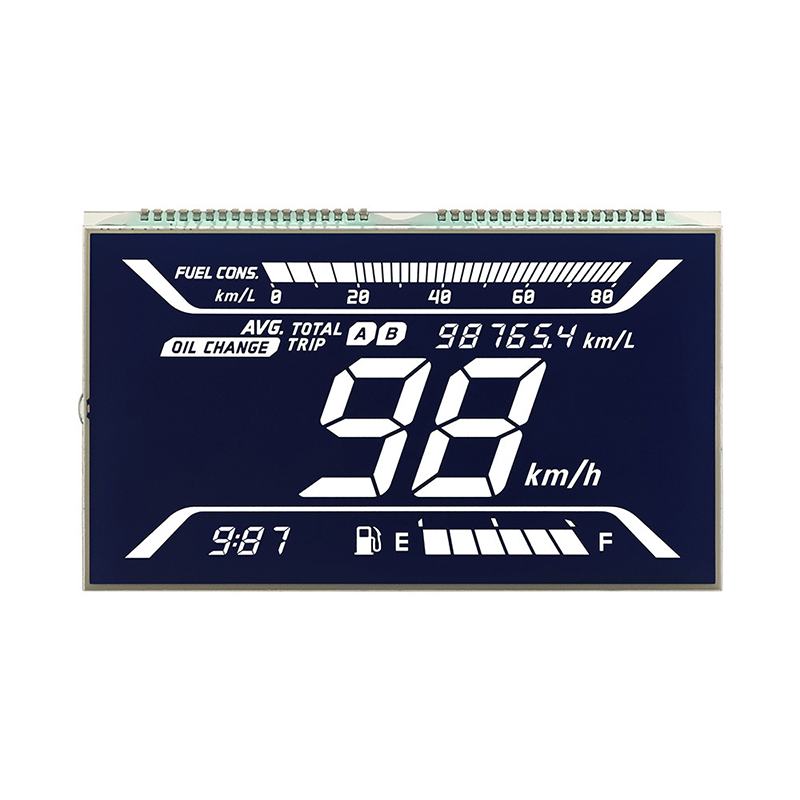

Analyzing specific market segments – such as foldable smartphones, automotive dashboards, or medical wearables – is essential. Each segment has unique characteristics impacting valuation and potential buyers. Consider the current market size, growth rate, and competitive landscape for your target segment. Identifying underserved niches can enhance your exit strategy. For example, a specialized flexible OLED display for medical applications may attract a niche buyer with higher valuation potential compared to a more generic product.

Several exit strategies exist for businesses involved in flexible OLED display technology. The best approach depends on your company's size, financial goals, and technological capabilities.

This is a common exit strategy involving selling your company or its assets to a larger player in the display or electronics industry. Potential buyers might include major display manufacturers, consumer electronics companies, or automotive manufacturers. The valuation will depend on factors like your technology's maturity, intellectual property portfolio, revenue streams, and market potential. A successful acquisition requires strong negotiation skills and a well-prepared business plan. Dalian Eastern Display Co., Ltd. (https://www.ed-lcd.com/) is an example of a company that could potentially be involved in such acquisitions or partnerships depending on the specifics of the technology.

A strategic partnership involves collaborating with another company to leverage complementary resources and expertise. This might involve licensing your technology, co-developing new products, or jointly marketing your flexible OLED display solutions. This path allows for continued involvement in the business while sharing risk and resources. It might be preferable to a full acquisition if you wish to retain some control over your technology's future.

An IPO involves listing your company's shares on a public stock exchange. This is a capital-intensive process, requiring significant financial preparation and meeting regulatory requirements. It's generally suitable for larger, well-established companies with a proven track record. An IPO offers the potential for significant returns but also exposes the company to greater public scrutiny.

Licensing your flexible OLED display technology allows others to manufacture and sell products using your intellectual property in exchange for royalties. This can be a less risky option compared to a full acquisition, especially if your technology is highly specialized or requires significant manufacturing investment. The royalty rates depend on various factors, including the technology's uniqueness and market demand.

The optimal exit strategy is highly dependent on your individual circumstances. Factors to consider include:

| Factor | Considerations |

|---|---|

| Financial Goals | Short-term vs. long-term gains, desired level of return |

| Company Size and Structure | Small businesses might benefit from acquisitions, while larger ones may consider an IPO. |

| Technology Maturity and IP Portfolio | Strong IP protection increases valuation potential |

| Market Conditions | Current market trends and competitive landscape greatly influence valuation. |

Consult with financial advisors and legal professionals to make an informed decision.

Disclaimer: This information is for general guidance only and does not constitute financial or legal advice. Conduct thorough due diligence and seek professional counsel before making any decisions related to your flexible OLED display business.