The decision to exit the Best Grove OLED display market requires careful planning and a deep understanding of various factors. This comprehensive guide explores effective strategies to maximize your return on investment while navigating the complexities of the display technology industry. Whether you're a manufacturer, distributor, or investor, understanding your options and preparing for a strategic exit is crucial. We'll delve into the key considerations, providing practical advice and insights to help you make informed decisions.

Before exploring exit strategies, a thorough assessment of your current situation is essential. This includes:

Analyze the current market conditions for Grove OLED displays. Consider factors such as demand, competition, technological advancements (like MicroLED or advanced AMOLED), and pricing trends. Understanding the overall health of the market will inform your strategic direction. You might also want to research the latest technological breakthroughs from companies like Samsung Display, LG Display, and BOE Technology to gauge future market directions.

Evaluate the financial health of your Grove OLED display business. This involves examining profitability, revenue streams, debt levels, and overall financial stability. A clear financial picture will help determine the viability of different exit strategies and their potential returns.

Assess your competitive position within the Grove OLED display market. Identify key competitors, analyze their strengths and weaknesses, and understand your market share. This assessment will help you understand your negotiating power and potential buyer interest.

Several exit strategies can be employed for a Grove OLED display business, each with its own advantages and disadvantages:

Selling your Grove OLED display business to another company is a common exit strategy. This can involve finding a strategic buyer (a competitor or a company in a related industry) or a financial buyer (a private equity firm or investment group). The valuation will depend on several factors, including profitability, market share, and future growth potential. It's essential to engage experienced advisors throughout the process.

Merging your Grove OLED display business with another company can offer synergistic benefits, creating a larger, more competitive entity. This often involves combining resources, technologies, and market share. It requires careful evaluation of the compatibility of the two businesses.

If your Grove OLED display business has reached a significant scale and meets specific financial criteria, an IPO could be a viable option. This involves listing your company's shares on a public stock exchange, providing access to a broader pool of capital and liquidity.

In certain circumstances, liquidation might be considered as a last resort. This involves selling off assets to pay off liabilities. It’s generally less desirable than other options as it typically yields a lower return.

The optimal exit strategy depends on several factors, including:

Regardless of the chosen strategy, meticulous preparation is vital. This includes:

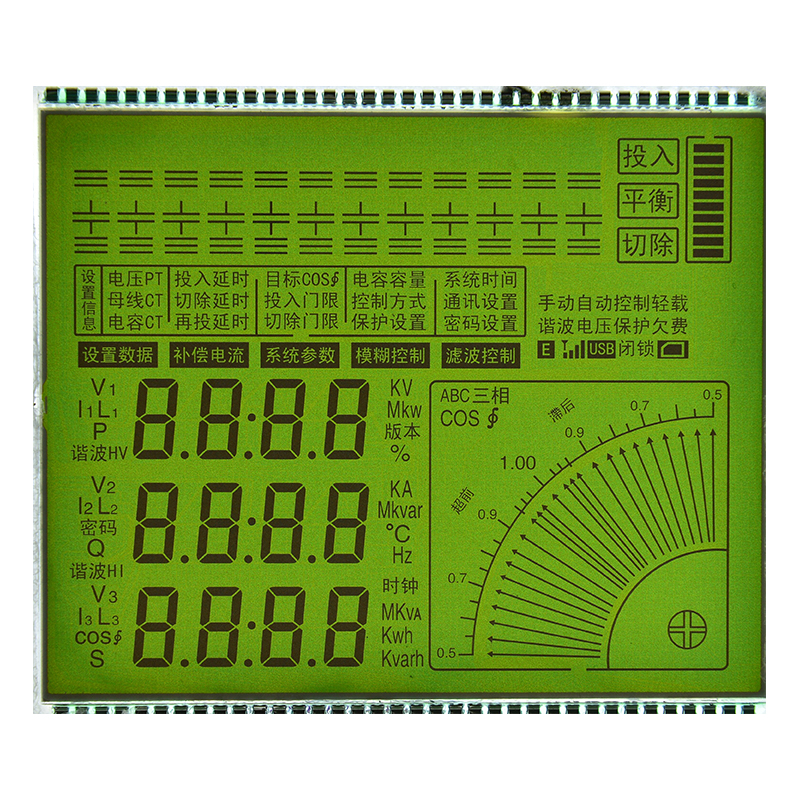

For more information on high-quality displays, consider exploring the offerings from Dalian Eastern Display Co., Ltd. They offer innovative solutions within the display industry.

Remember that navigating the exit strategy process for your Grove OLED display business requires careful planning, market knowledge, and professional guidance. Thorough preparation is key to maximizing your return on investment and securing a successful outcome.