This guide explores the optimal strategies for exiting the Liquid Crystal Display (LCD) market, considering various factors such as market trends, technological advancements, and financial considerations. We'll examine different exit paths and help you determine the best approach for your specific situation. Learn about potential buyers, valuation methods, and the crucial steps involved in a successful Best LCD exit.

The LCD market is dynamic, facing continuous challenges from emerging technologies like OLED and MicroLED. Understanding these trends is crucial for planning a successful Best LCD exit. Factors such as declining prices, increased competition, and shifting consumer preferences need careful consideration. A thorough market analysis is essential before making any decisions. You should research the latest reports from industry analysts to gain a comprehensive understanding of the present and future landscape.

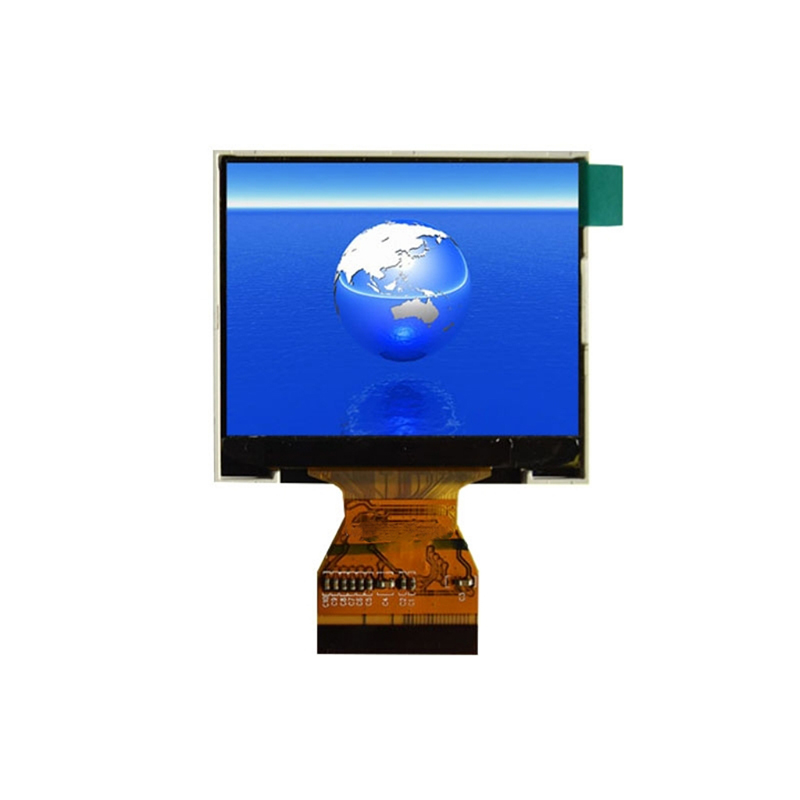

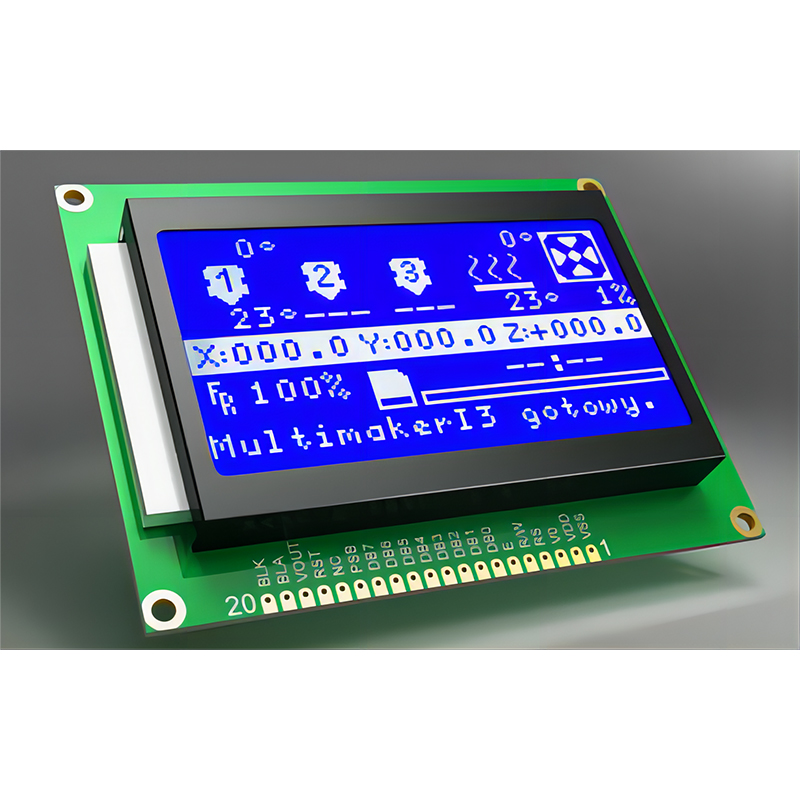

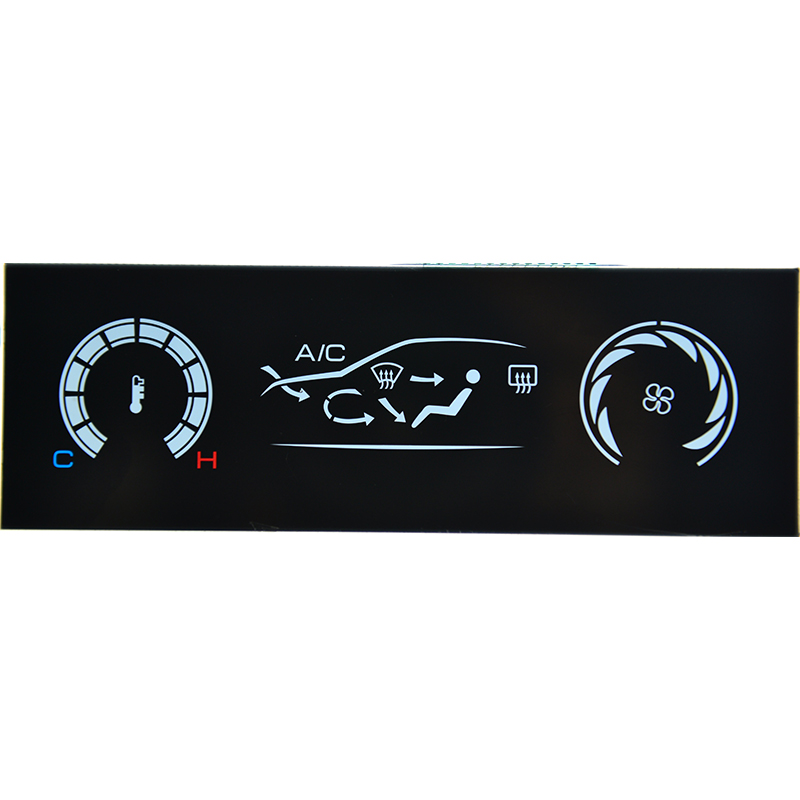

Technological innovations continually reshape the LCD market. The rise of higher-resolution displays, improved energy efficiency, and the development of flexible LCDs are examples of such advancements. These developments impact the valuation of LCD businesses, making it important to understand their implications for your Best LCD exit strategy. For example, companies specializing in niche applications of older LCD technology may find more longevity than those focused on mainstream consumer products.

Selling your LCD business to a larger competitor is a common exit strategy. This allows for a relatively quick and efficient transition, potentially maximizing your return. However, it also requires careful negotiation to ensure a fair valuation. The potential buyer will analyze your assets, including intellectual property, manufacturing facilities, and market share, to determine an appropriate price. Seek expert legal and financial advice throughout this process.

Private equity firms often seek out established businesses with strong potential for growth. If your LCD company fits this profile, this could be a viable exit strategy. These firms typically have a longer-term investment horizon and might be willing to invest in further developing your business before eventually selling it. However, it's essential to find a firm with a proven track record in the technology sector.

A strategic partnership or joint venture allows you to combine resources and expertise with another company, potentially expanding your market reach and improving profitability. This can be a less disruptive exit strategy than a complete sale, especially if you wish to maintain some involvement in the business. Consider what complementary resources and capabilities you would look for in a partner to enhance the overall value proposition.

In certain circumstances, liquidation may be the most suitable Best LCD exit strategy. This involves selling off assets individually, which might result in a lower overall return compared to a sale as a whole entity. It should be a last resort, considered when other strategies are not feasible. Carefully weigh the potential benefits and drawbacks.

Accurately valuing your LCD business is crucial for successful negotiations. This involves considering various factors, including revenue, profitability, market share, and future growth potential. Engage experienced professionals for a fair assessment to optimize your return during the Best LCD exit process. Remember, many factors impact final valuation, and finding the right buyer willing to pay a premium for specific assets is key.

Thorough due diligence is essential to protect your interests. This involves a comprehensive review of your financial records, legal compliance, and intellectual property rights. This ensures a smooth and efficient transition process during your Best LCD exit. Engaging expert legal and financial consultants is advisable.

Planning for your life after exiting the LCD business is crucial. Consider your future financial goals and how you will manage your assets. Financial planning and investment strategies should be developed alongside your exit strategy. This ensures a smooth transition from the operational phase to the post-exit stage of your business life cycle.

The optimal Best LCD exit strategy depends on your specific circumstances. Carefully weigh the pros and cons of each option, considering your financial goals, market conditions, and personal preferences. Seeking professional advice from financial advisors, legal counsel, and industry experts is highly recommended.

For more information about high-quality LCD panels and solutions, consider exploring Dalian Eastern Display Co., Ltd.’s offerings. They are a leading provider of advanced display technologies.