This guide explores the optimal approaches for exiting the LCD glass market, considering various factors impacting profitability and market trends. We'll examine strategies for businesses seeking to maximize returns while navigating the complexities of this dynamic industry.

The LCD glass market is highly competitive and subject to rapid technological advancements. Factors such as the rise of OLED technology, fluctuating raw material prices, and evolving consumer demands necessitate a strategic approach to exiting the market. A successful Best lcd glass exit requires a comprehensive understanding of these forces and a well-defined plan.

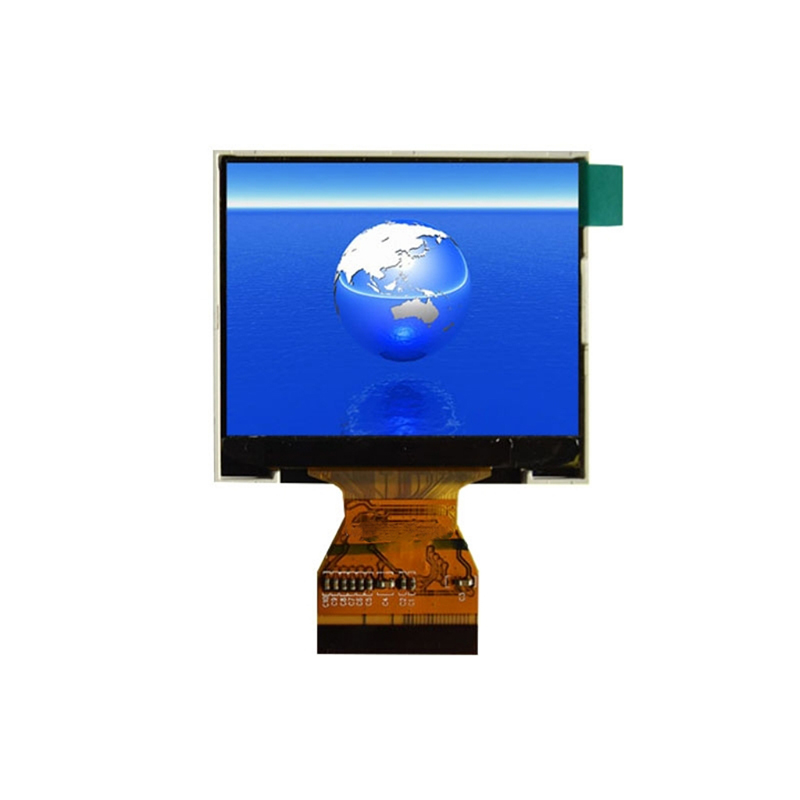

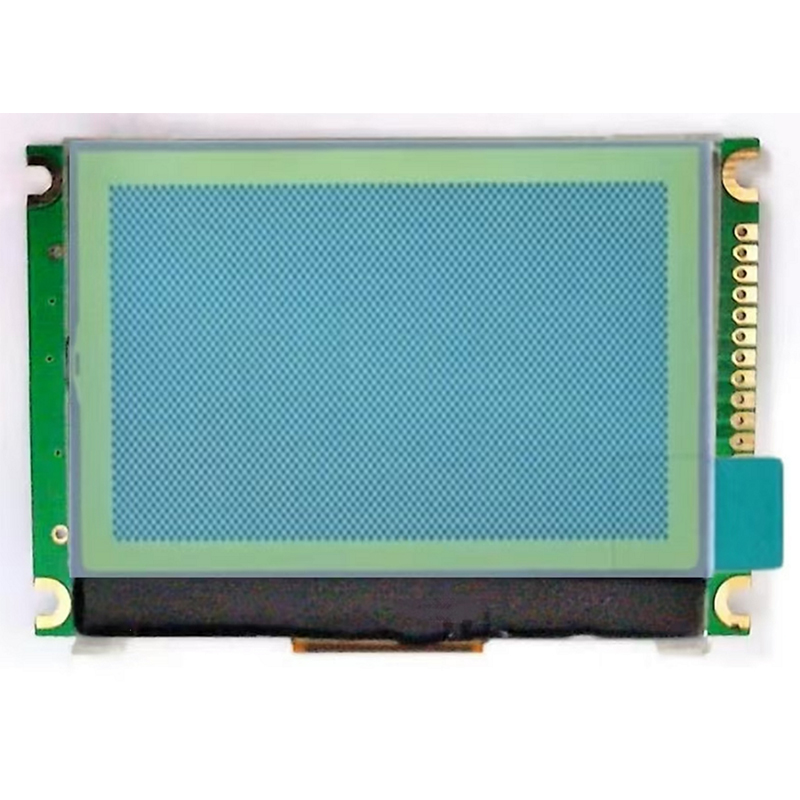

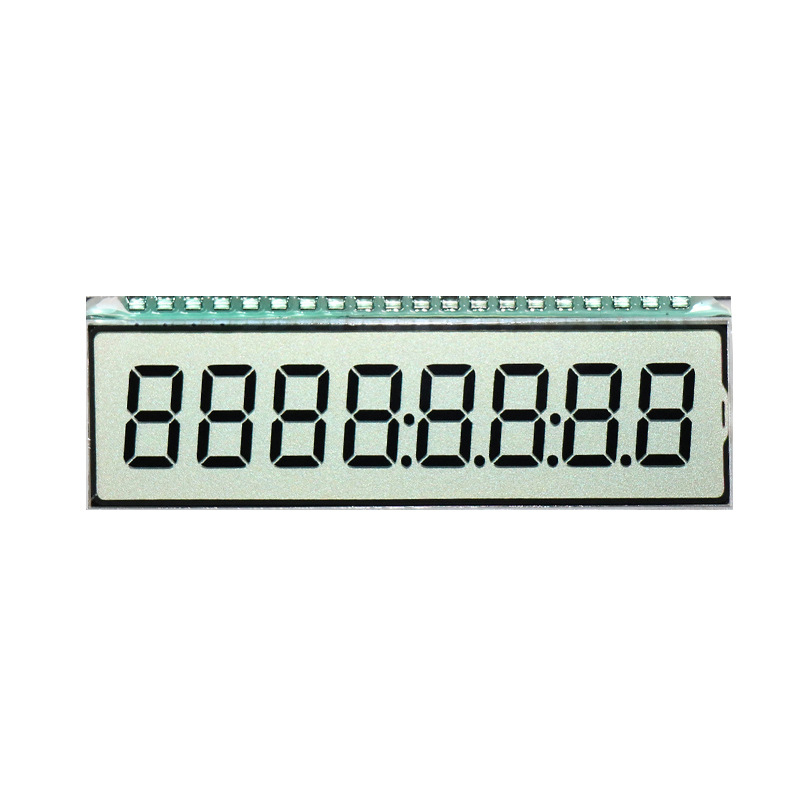

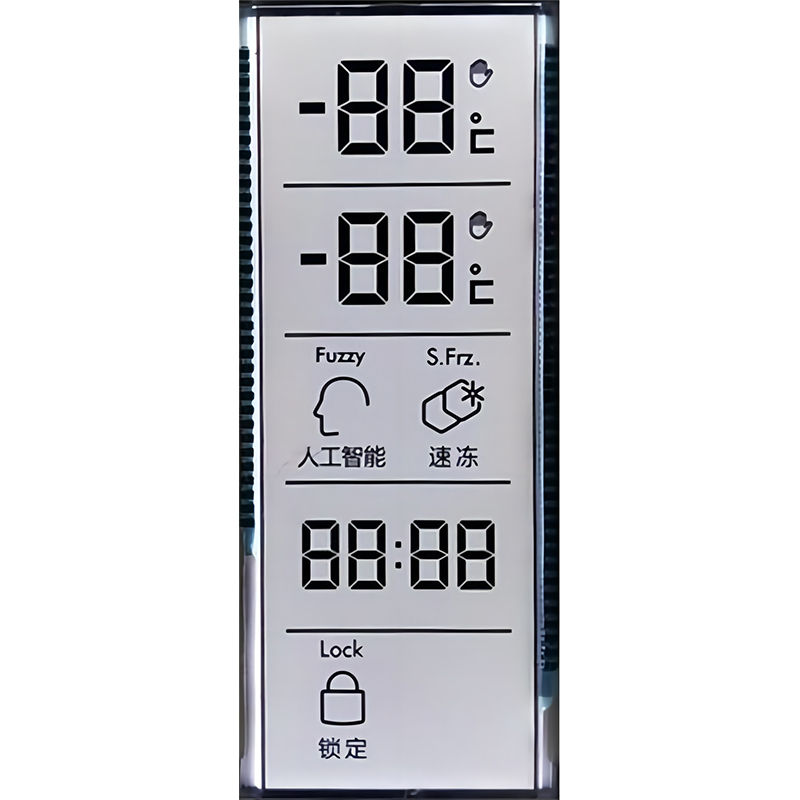

Exiting the LCD glass market may present various challenges. These can include asset liquidation, managing inventory, fulfilling existing contracts, and navigating potential legal or regulatory hurdles. Thorough due diligence and a clear plan are essential to mitigating these risks. Companies like Dalian Eastern Display Co., Ltd. (https://www.ed-lcd.com/), a leading LCD manufacturer, understand these intricacies and can offer valuable insights into navigating these complexities. They provide a wide range of high-quality LCD products and understand the importance of strategic market exits.

One viable option is to explore strategic partnerships or acquisitions. This could involve selling the company's assets or intellectual property to a larger competitor or a company looking to expand its presence in the LCD glass market. Such a strategy allows for a controlled and potentially lucrative exit, minimizing disruption and ensuring a smooth transition.

A phased liquidation strategy allows for a gradual exit from the market. This approach involves systematically winding down operations, selling off assets and inventory over a period of time. This minimizes risk and allows for more control over the process, potentially optimizing returns. The key is to maintain transparency and communicate effectively with stakeholders throughout the process.

Consolidation with other players in the industry could lead to a more efficient and sustainable market presence. This may involve mergers, joint ventures or other collaborative arrangements. This could create synergies, reduce redundancies, and increase market share for the combined entity. However, thorough due diligence is required to ensure compatibility and minimize potential conflicts.

A comprehensive financial assessment is crucial for determining the best exit strategy. This involves evaluating the company's assets, liabilities, and overall financial health. This will help determine the optimal valuation and the most suitable exit option.

Before implementing any Best lcd glass exit strategy, it's crucial to ensure full compliance with all applicable legal and regulatory requirements. This includes labor laws, environmental regulations, and contract obligations. Ignoring this aspect can lead to significant financial and legal repercussions.

The optimal Best lcd glass exit strategy depends on a variety of factors specific to your company’s circumstances. These include your financial position, market standing, strategic goals, and the overall market landscape. Thorough analysis and professional guidance are essential in making the right decision.

Consider consulting with industry experts and financial advisors to develop a tailored strategy that aligns with your business goals and minimizes potential risks. A carefully planned exit can lead to a positive outcome and secure a successful future for your organization.