Best LED TFT Display Exit Strategies: A Comprehensive GuideFinding the optimal exit strategy for your Best LED TFT display business is crucial for maximizing returns and ensuring a smooth transition. This guide explores various exit strategies, their advantages and disadvantages, and factors to consider for a successful handover. We'll delve into the specifics of valuing your business, preparing for the sale, and navigating the legal and financial aspects of the process.

Understanding Your LED TFT Display Business

Valuing Your Assets

Before exploring exit strategies, accurately valuing your

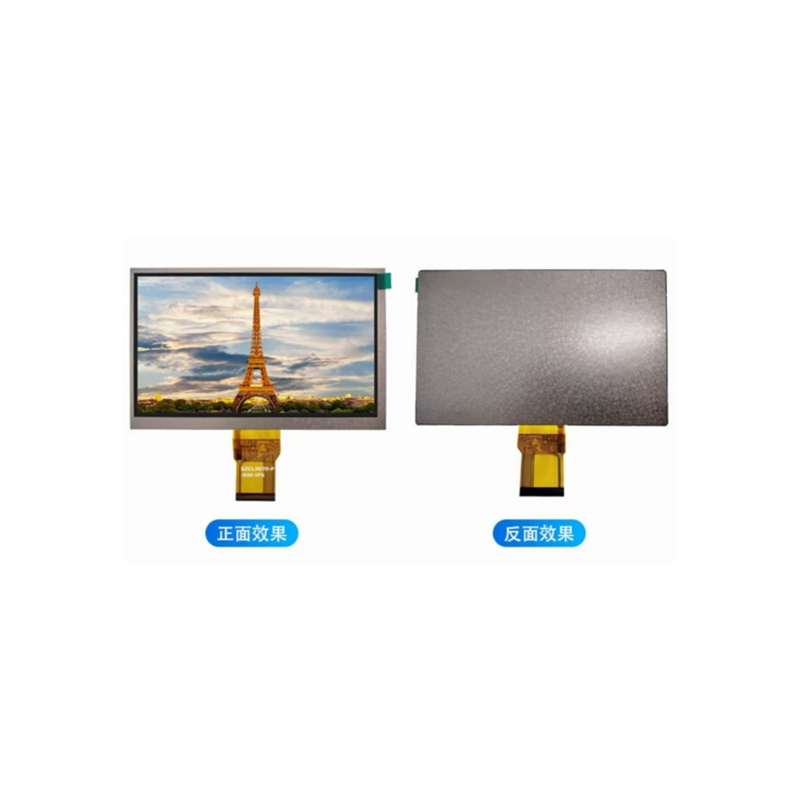

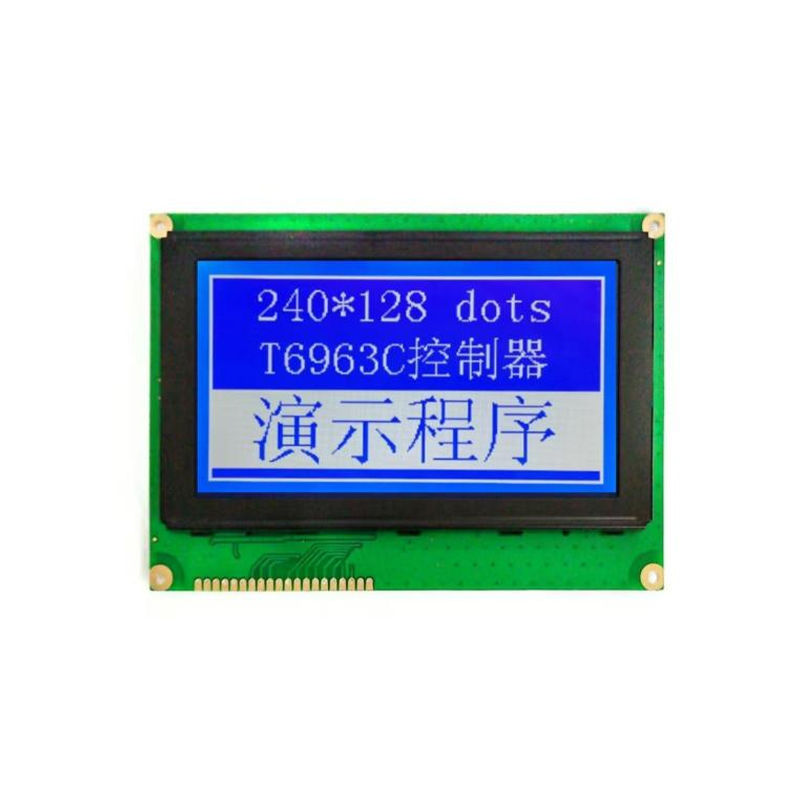

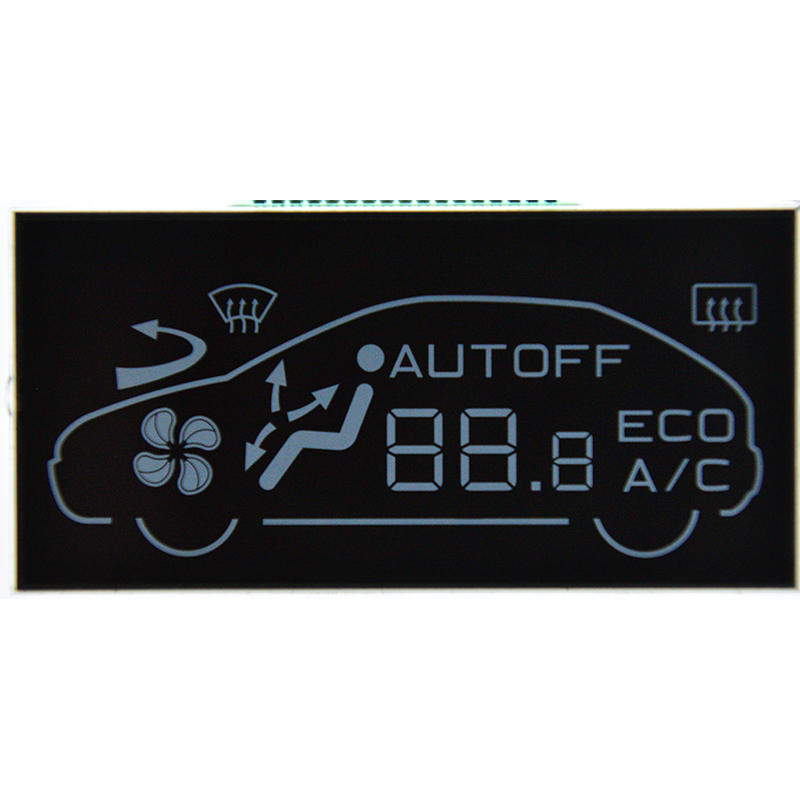

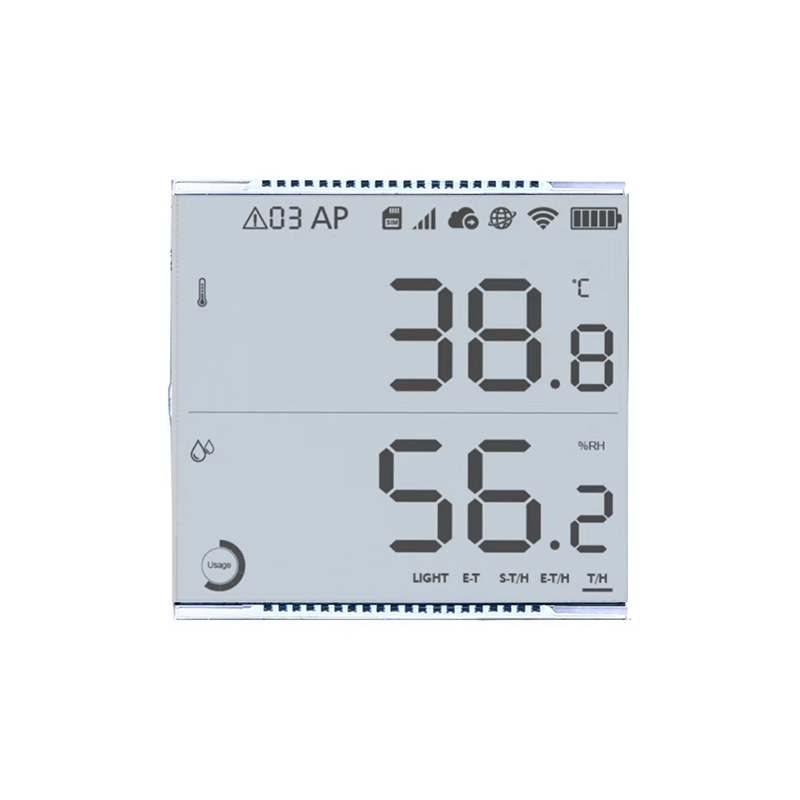

Best LED TFT display business is paramount. This involves assessing various aspects, including tangible assets (inventory, equipment, etc.), intangible assets (brand reputation, intellectual property), and future earnings potential. Engaging a professional business valuation expert is highly recommended to ensure an objective and accurate assessment. Remember to consider market trends and competition when determining your asking price. Factors such as the quality and reliability of your

Best LED TFT display products, your established customer base, and your operational efficiency significantly impact your business's overall valuation.

Exploring Exit Strategies for Your Business

Acquisition by a Larger Company

This involves selling your business to a larger company in the same industry or a related field. This can provide a substantial return on your investment, but it also requires careful negotiation and due diligence to ensure a fair deal. The acquiring company will likely scrutinize your financials, operations, and future projections. Consider the cultural fit between your company and potential acquirers, as a mismatch can negatively impact the long-term success of the integration. Seeking professional legal and financial advice during this process is highly recommended. Large companies often look for businesses with strong growth potential and a proven track record, so showcasing your success with your

Best LED TFT display products will be crucial.

Merger with Another Company

A merger combines your business with another company, creating a new entity. This strategy can benefit from synergies between the two companies, expanding market reach and resources. However, it requires careful planning and agreement on the terms of the merger, including ownership structure, management roles, and future direction. Mergers can be complex and require a significant commitment from all parties involved. A successful merger requires a thorough understanding of each company's strengths and weaknesses, and a clear strategy for integration.

Strategic Partnership

For a less drastic change, consider a strategic partnership. This involves collaborating with another company to leverage complementary resources and expand your market reach. This strategy allows you to maintain ownership and control of your

Best LED TFT display business while benefiting from the partnership's advantages. Choose a partner whose values align with yours, and whose expertise complements yours. This type of partnership can help you reach new customers and markets, but be prepared to share profits and decision-making power.

Selling to Private Equity

Private equity firms invest in businesses with high growth potential. This can be a lucrative option, but it involves relinquishing a degree of control and accepting the firm's investment terms. Private equity firms often focus on improving efficiency and increasing profitability, so be prepared for significant changes within your business post-acquisition. They often conduct extensive due diligence and require robust financial reporting. Understand the implications of private equity ownership before proceeding.

Liquidation

This involves selling off your assets individually, such as your inventory of

Best LED TFT displays, equipment, and other resources. While this is the simplest exit strategy, it usually provides the lowest return compared to other options. This should be a last resort, considered only after exploring other viable options. It's important to market your assets effectively to maximize their value.

Preparing for Your Exit Strategy

Regardless of your chosen exit strategy, thorough preparation is essential. This involves: Financial Due Diligence: Ensure your financial records are up-to-date, accurate, and readily accessible. Legal Documentation: Have all relevant legal documents in order, including contracts, licenses, and intellectual property rights. Marketing Materials: Prepare professional marketing materials that highlight your business's strengths and value proposition. Consider emphasizing the quality and innovative features of your

Best LED TFT display products. Experienced Advisors: Secure the services of experienced legal, financial, and business advisors to navigate the complexities of the process.

Conclusion

Choosing the right exit strategy for your

Best LED TFT display business requires careful consideration of your goals, resources, and market conditions. By understanding the various options and conducting thorough research, you can ensure a smooth and successful transition. Remember to consult with experienced professionals throughout the process to maximize your return and minimize potential risks. Consider contacting Dalian Eastern Display Co., Ltd. (

https://www.ed-lcd.com/) for potential partnerships or collaborations in the LED display market.

| Exit Strategy | Advantages | Disadvantages |

| Acquisition | High potential return, access to resources | Loss of control, potential cultural clashes |

| Merger | Synergies, expanded market reach | Complex negotiations, integration challenges |

| Strategic Partnership | Maintain control, access to complementary resources | Shared profits, decision-making |

| Private Equity | Significant capital infusion, expertise | Loss of control, potential for significant changes |

| Liquidation | Simple process | Lowest return, time-consuming |