Choosing the right exit strategy for your small LCD project is crucial for maximizing return on investment (ROI) and ensuring a smooth transition. This comprehensive guide explores various options, considering factors like market demand, technology advancements, and your specific business goals. We'll analyze the pros and cons of each strategy to help you make an informed decision.

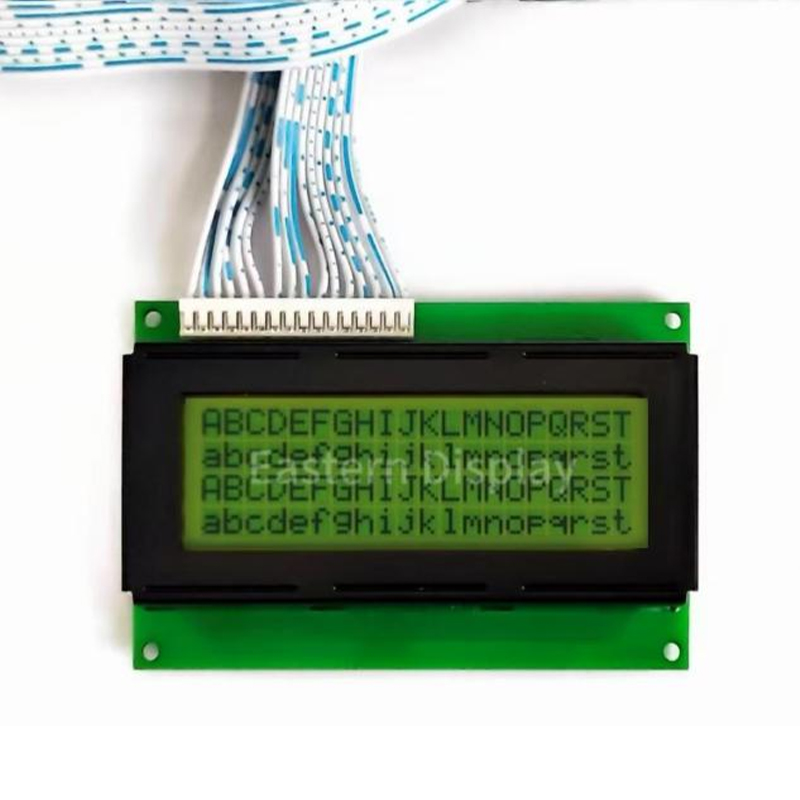

This is a common exit strategy where a larger company in the electronics or display industry acquires your small LCD project. The acquisition price depends on factors such as your technology's uniqueness, market share, and projected future growth. A successful acquisition requires a strong business plan demonstrating the value proposition of your best small LCD exit strategy. Consider the resources and expertise a larger company can offer; you’ll need to weigh these against potential loss of control. Companies like Dalian Eastern Display Co., Ltd. (https://www.ed-lcd.com/), a leading manufacturer of LCD displays, might be a potential acquirer depending on your project's specifics. Remember to meticulously document your intellectual property (IP) to strengthen your negotiating position.

Instead of a full acquisition, a strategic partnership or joint venture allows you to retain some ownership while accessing resources and market reach from a larger partner. This is a particularly attractive best small LCD exit option if your technology complements another company's existing offerings. This route shares risks and rewards, potentially offering a slower but more stable return than an outright sale. Collaborating with companies specializing in complementary technologies, such as driver ICs or backlight systems, could be highly beneficial.

An IPO involves taking your company public by listing its shares on a stock exchange. This option is usually considered for larger, more established businesses with a proven track record. While potentially very lucrative, an IPO requires significant preparation, including financial reporting transparency and adhering to strict regulatory requirements. For small LCD projects, this path is often less feasible due to the extensive regulatory hurdles and financial investment needed.

Licensing your LCD technology grants other companies the right to use your intellectual property in exchange for royalties. This strategy is suitable if your focus is less on direct manufacturing and more on IP monetization. It allows for a passive income stream while minimizing operational involvement. Thorough legal agreements are crucial to protect your interests and ensure compliance. Effectively licensing your best small LCD exit technology requires a clear understanding of your IP portfolio and market valuation.

Private equity firms invest in companies with significant growth potential. They are often interested in smaller ventures that might not be attractive to large corporations. They typically aim to improve operations and then sell the company at a higher price after a period of investment. This exit strategy involves giving up some control and may require conforming to the investor's strategies.

The optimal best small LCD exit strategy depends on several factors:

| Factor | Considerations |

|---|---|

| Market Conditions | Demand for your technology, competitive landscape, overall economic climate. |

| Financial Performance | Revenue, profitability, cash flow – vital for attracting buyers or investors. |

| Intellectual Property | Strength and protection of your patents and trade secrets. |

| Management Team | Experience and capabilities of your team; valuable to potential acquirers. |

Careful planning and due diligence are essential for a successful exit. Consulting with financial and legal professionals is highly recommended.