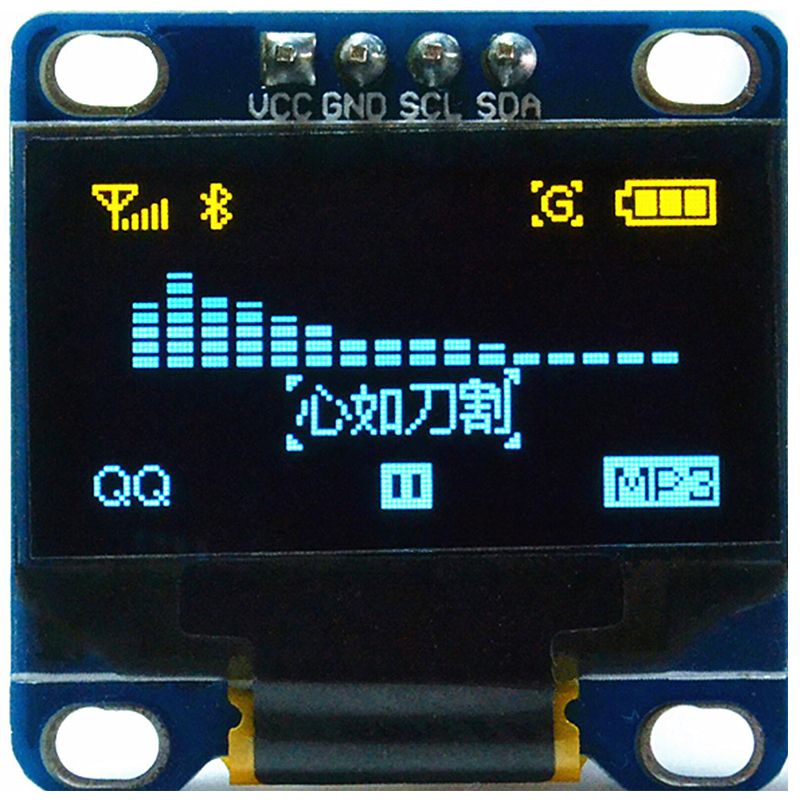

Finding the perfect square OLED display can be challenging. This guide explores top contenders, comparing features, specifications, and applications to help you make an informed decision. We'll delve into resolution, brightness, contrast, and other crucial factors to consider when selecting a Best square OLED display for your needs.

Square OLED displays offer a unique aspect ratio, often preferred for specific applications like digital signage, industrial displays, or specialized gaming monitors. Unlike traditional widescreen displays, the square format provides a different viewing experience and can be beneficial for certain content. The key advantages of OLED technology in this format include perfect blacks, incredible contrast ratios, and vibrant colors, all contributing to a superior visual experience. When choosing a Best square OLED display exit, these aspects should be high on your priority list.

Before purchasing, carefully evaluate these critical specifications:

While a definitive best depends on individual requirements, several manufacturers produce high-quality square OLED displays. Research specific models from reputable brands, comparing specifications based on your needs. Unfortunately, a comprehensive list of every available Best square OLED display exit is beyond the scope of this single article due to the rapidly changing market. You should check independent review sites for the most up-to-date information. For custom solutions, consider contacting Dalian Eastern Display Co., Ltd.— a leading manufacturer specializing in customized display solutions.

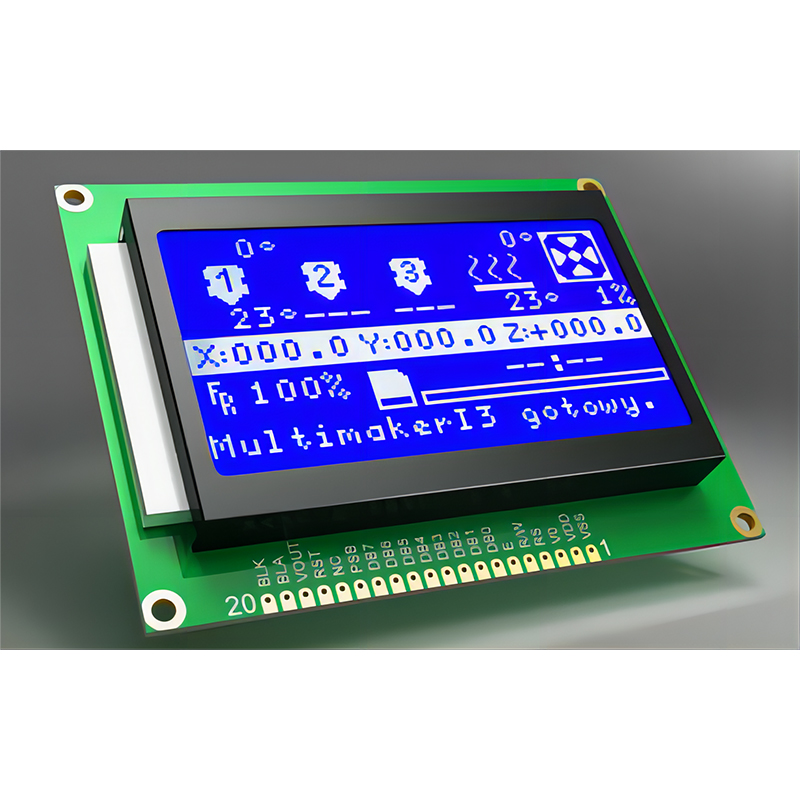

For digital signage applications, prioritize brightness and viewing angles to ensure visibility in various lighting conditions. A high resolution is also crucial for displaying crisp and clear information.

Industrial settings often demand robust displays with wide operating temperature ranges and high durability. Consider features like protective glass or sealed enclosures for harsh environments. A reliable manufacturer, such as Dalian Eastern Display Co., Ltd., will be able to assist you with your specific requirements.

The price of a Best square OLED display varies significantly depending on several factors:

| Factor | Impact on Price |

|---|---|

| Resolution | Higher resolution = Higher price |

| Size | Larger displays = Higher price |

| Brightness | Higher brightness = Higher price |

| Features | Additional features (touchscreen, etc.) = Higher price |

| Brand | Premium brands often command higher prices |

Remember to carefully weigh the specifications against your budget to find the best value for your money.

This guide provides a starting point for your search for the Best square OLED display exit. Always thoroughly research specific models and read reviews before making a purchase. For specialized or custom requirements, seeking consultation with a display manufacturer is recommended.