Exiting the TFT screen market requires careful planning and execution. This comprehensive guide provides a structured approach to navigating the complexities involved, considering diverse factors and offering actionable strategies for a successful transition. We'll delve into market analysis, financial considerations, and strategic partnerships to help you effectively manage your exit.

The TFT screen market is dynamic, with continuous technological advancements and shifting consumer preferences. Before strategizing an exit, a thorough understanding of current market trends is crucial. This includes analyzing factors such as:

Assess the level of competition within the TFT screen market segment you operate in. Is the market saturated? Are there emerging technologies posing a significant threat? Understanding this competitive landscape informs the timing and method of your exit strategy. Consider consulting market research reports to gain a deeper understanding of the current market dynamics.

The rapid pace of technological change necessitates a careful evaluation of emerging display technologies like OLED, QLED, and MicroLED. These advancements may impact the demand for TFT screens, influencing the feasibility and timeline of your exit strategy. Staying informed on these developments is crucial for making informed decisions.

Ensure your exit strategy complies with all relevant regulations and environmental standards. Proper disposal or recycling of TFT screens is crucial, and adherence to regulations minimizes potential legal and financial repercussions. Consult relevant regulatory bodies for specific compliance requirements.

Several strategic options exist for exiting the TFT screen market, each with its own advantages and disadvantages.

Selling your TFT screen business to a larger company or competitor is a common exit strategy. This can provide a significant return on investment and a smooth transition for your stakeholders. However, finding a suitable buyer may require time and effort, and negotiations can be complex.

Liquidation involves selling off assets and winding down operations. This may be appropriate if the business is unprofitable or facing significant challenges. However, liquidation may not yield the same return as a sale or acquisition. Consult with financial advisors to navigate the complexities of liquidation effectively.

A phased wind-down involves gradually reducing operations over a period of time. This allows for a more controlled exit, minimizing disruptions and providing opportunities to fulfill existing contracts. This strategy requires careful planning and execution to mitigate potential risks.

Partnering with a company specializing in a complementary technology or market segment can offer a strategic exit path. This approach can extend the lifespan of existing TFT screen products or leverage synergies to explore new avenues.

Thorough financial planning and due diligence are essential before initiating any exit strategy. This includes:

Accurately assessing the value of your TFT screen business assets, including intellectual property, equipment, and inventory, is crucial for successful negotiations. Engaging professional valuators ensures a fair and accurate appraisal.

Consult tax professionals to understand the tax implications of your chosen exit strategy. Proper planning can help minimize tax liabilities and optimize your return on investment.

Review all legal and contractual obligations to ensure compliance and a smooth transition. This includes contracts with suppliers, customers, and employees.

To maximize the chances of a successful exit, consider these best practices:

Remember, a successful TFT screen exit strategy requires careful planning, thorough due diligence, and a comprehensive understanding of market dynamics. By following these guidelines, you can increase your chances of achieving a smooth and profitable transition.

| Exit Strategy | Advantages | Disadvantages |

|---|---|---|

| Sale/Acquisition | High potential return, smooth transition | Finding a buyer can be challenging, negotiations can be complex |

| Liquidation | Quick and decisive | May not yield optimal return |

| Phased Wind-Down | Controlled exit, minimizes disruptions | Time-consuming, requires careful planning |

| Strategic Partnership | Leverage synergies, explore new avenues | Requires finding a compatible partner |

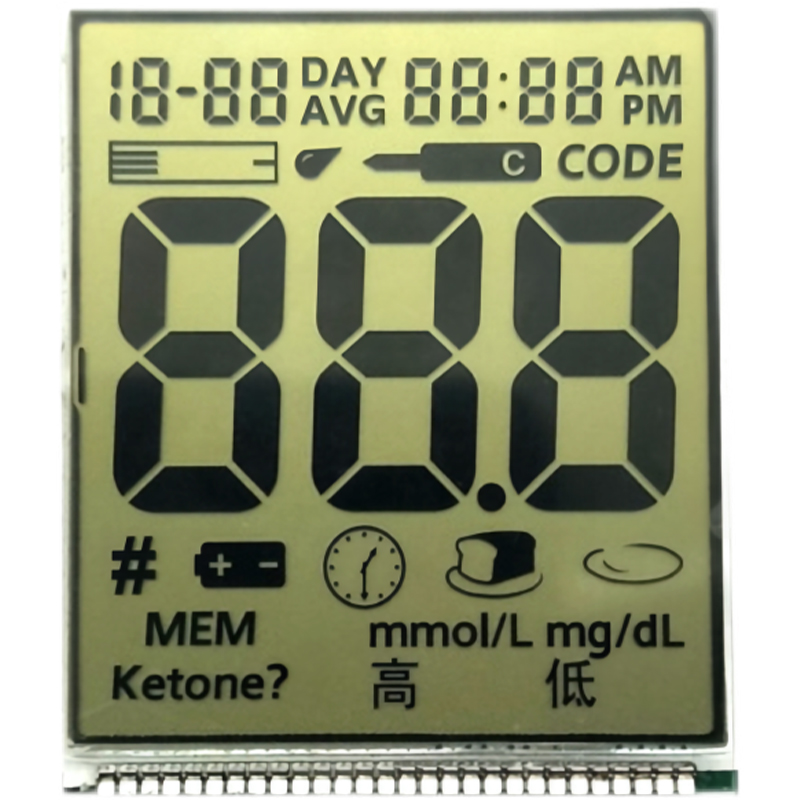

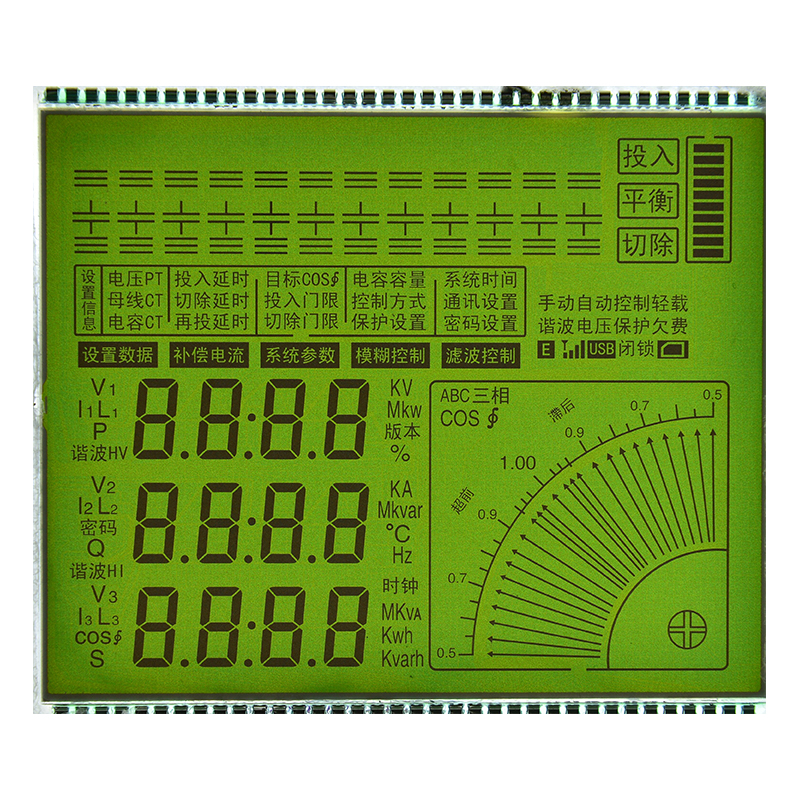

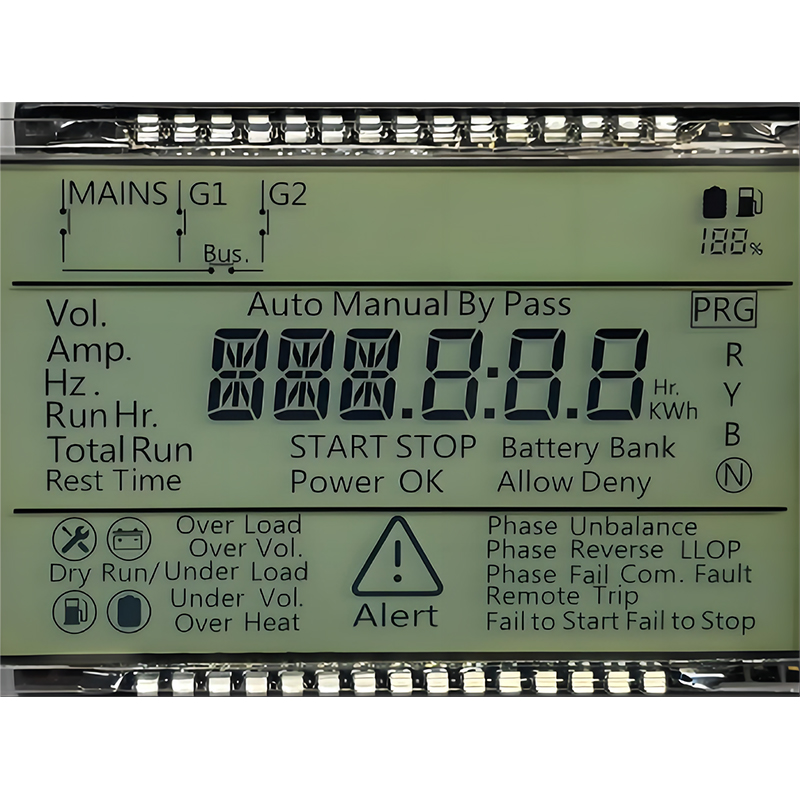

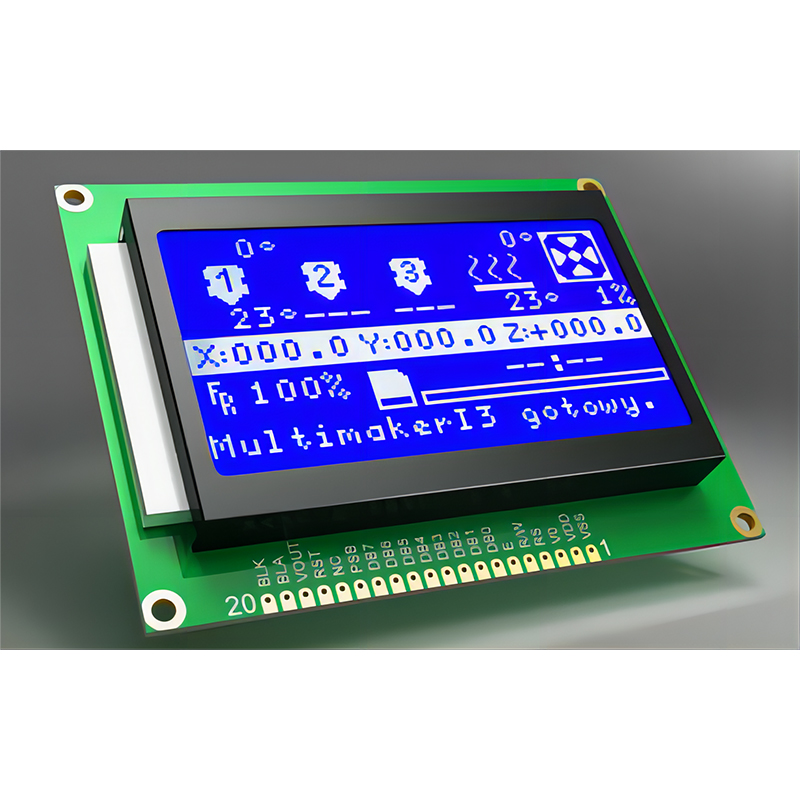

For high-quality TFT screens and related display solutions, consider exploring options from leading manufacturers. Dalian Eastern Display Co., Ltd. offers a wide range of products and services.

Disclaimer: This information is for educational purposes only and should not be considered professional financial or legal advice. Consult with qualified professionals for guidance specific to your situation.